Disclaimer: This blog post is not investment advice. Please do your own due diligence before making any investment decisions.

For this blog, we will mainly discuss Blackstone, Brookfield, and The New York Times, along with their valuation aspects.

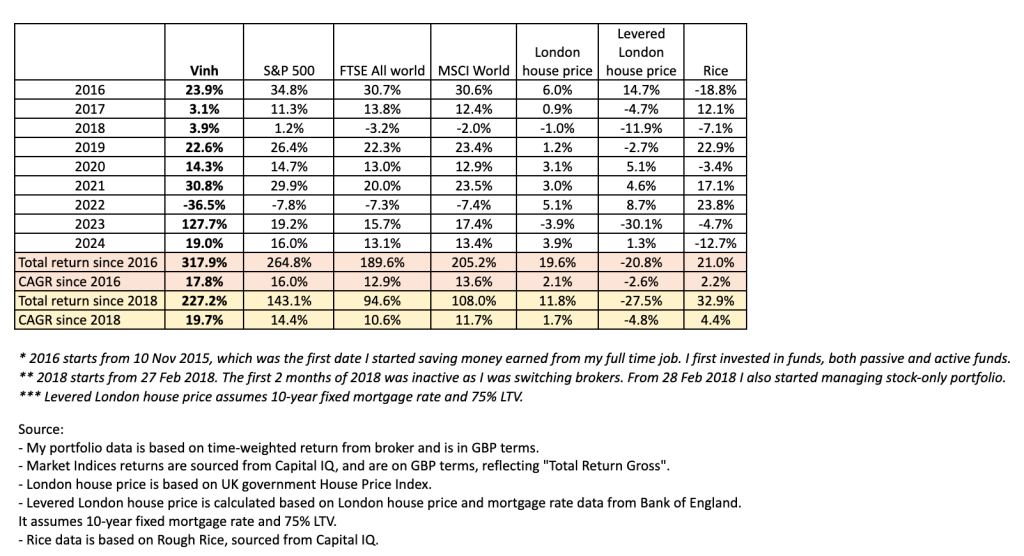

Performance

Blackstone

Blackstone is focusing on investing in data centers due to the rising need for digital infrastructure from AI and cloud computing. Its $16 billion acquisition of AirTrunk, the largest data center operator in Asia-Pacific, shows its commitment to expanding in this area. This investment helps Blackstone meet the demands of tech companies and businesses needing modern data storage and processing. By targeting valuable, fast-growing assets, Blackstone aims to secure steady cash flows and strengthen its position in the digital infrastructure market.

“We are now the largest data center operator in the Asia-Pacific region, thanks to our strategic acquisition of AirTrunk, which positions us well to meet the growing demands of AI and cloud services.”

Source: Blackstone Q3 2024 Earnings Call Transcript

Blackstone’s private credit platform is growing, with $432 billion in assets. Their services, which include direct lending and CLOs, are attracting strong investments due to lower base rates and higher demand for private credit. The credit business is crucial for their growth, enabling them to offer complete financial solutions across different sectors. As base rates go down, private credit becomes more appealing, boosting transaction activity and interest in Blackstone’s credit products.

“Private players like Blackstone currently have only 1-2% of the market share, which leaves significant room for growth.”

Source: Blackstone Q3 2024 Earnings Call Transcript

Blackstone has actively invested over $50 billion in Q3, showing confidence in the market and their skill in spotting good opportunities during uncertain times. Their focus has been on key areas like digital infrastructure, renewable energy, and enterprise software, setting them up for future growth. This approach should help them deliver better returns for shareholders.

“In Q3, for the second consecutive quarter, we invested or committed over $50 billion, the highest in more than two years.”

Source: Blackstone Q3 2024 Earnings Call Transcript

Brookfield

As Sachin Shah, CEO of Brookfield Reinsurance, highlighted, “We have scaled our Wealth Solutions business from $2 billion… to $110 billion today and growing.”

This strategy is distinct from Blackstone, which does not write annuities but instead provides investment solutions to insurers holding annuity books. Brookfield’s approach allows them to leverage the entire insurance value chain, whereas Blackstone remains focused on asset management and advisory for insurers. Whilst this is attractive from a leveraged return point of view, it addes some risk to the operation, and therefore “in Brookfield we trust…[that the underwriting will be conservative and adhere to principle of certainty and predictability]”.

Brookfield’s real estate business is seeing a resurgence as markets begin to recover, particularly in key urban areas. The company has taken advantage of lower borrowing costs and a reduction in new supply, focusing on high-quality assets in sectors such as logistics, multi-family housing, and office space in top-tier cities. With a disciplined approach, Brookfield is strategically acquiring undervalued properties that offer significant upside potential as demand recovers.

Brookfield has also been optimizing its real estate portfolio by disposing of non-core assets and recycling capital into projects that are aligned with long-term growth trends. CEO Bruce Flatt noted that their deep expertise in managing and developing properties is a core strength that sets them apart from competitors. As the economic landscape stabilizes, Brookfield aims to expand its real estate footprint, capitalizing on the increasing need for modern logistics facilities and sustainable residential properties.

“Capital flows are returning to commercial real estate, and that’s driving the ability to see more transaction volume. The fact is this the bottom is behind us. Values have troughed, rates have peaked, capital markets are opening and that’s going to drive a pretty robust recovery across real estate markets generally.”

Source: Brookfield Corporation Analyst/Investor Day, September 2024

The New York Times

The New York Times added 300,000 net new digital subscribers in Q3, bringing them closer to their target of 15 million total subscribers. Engagement remains at a multiyear high, with 45% of subscribers now on their bundle, which includes news, games, cooking, and more. The strategic focus on bundling has helped drive both engagement and higher ARPU over time. By providing value across different content verticals, the Times has effectively increased subscriber loyalty and positioned itself as a comprehensive digital media solution for curious audiences.

“We are well on the path to our next milestone of 15 million subscribers, with engagement reaching a multiyear high.”

Source: New York Times Q3 2024 Earnings Call“I’d say that’s all kind of what we expect to happen. That’s the strategy working. So on the bundle, we decided some time ago now, let’s call it, it started in ’22, but a year ago that we would make the bundle the product that most people were directed to buy and make it compelling to most people to buy. So we brought the bundle to a promotional price. And that, of course, had a very positive effect on getting people to buy the bundle, but was fundamentally and strategically dilutive to ARPU on the bundle. I’ll just remind you, bundle subscribers ultimately over time pay the most, engage best, retain best. The opposite has happened in News, again by design. We actually—this doesn’t get talked about very much—we stopped marketing News only. So it’s very difficult if you just want to buy News, very difficult to do that. We don’t actively market it. And we haven’t actively marketed, I want to say, for roughly a year now. And so what that means is if you are a News subscriber, two things are true: one, you’re very likely to be tenured, which means you’ve been subject to some number of price increases; and two, you’re not on the promotion. So that sort of explains the difference.”

Source: New York Times Company Conference Presentation, September 2024

The Times has been actively expanding its product offerings, particularly in lifestyle content like Games and Sports. New initiatives such as “Scoop City” for NFL coverage and the addition of Wordle archives have helped attract new subscribers and deepen engagement, reinforcing their strategy of becoming an essential subscription for a broader audience. This diversification into lifestyle and entertainment content has allowed The New York Times to reach beyond traditional news readers and tap into new demographics, making the subscription more valuable and stickier.

“We are proving out that being in sports and games and recipes funnels to the bundle, driving engagement and subscriber growth.”

Source: New York Times Company Conference Presentation, September 2024“Our lifestyle products like Cooking and Games are key drivers of subscriber acquisition and retention.”

Source: New York Times Company Conference Presentation, September 2024

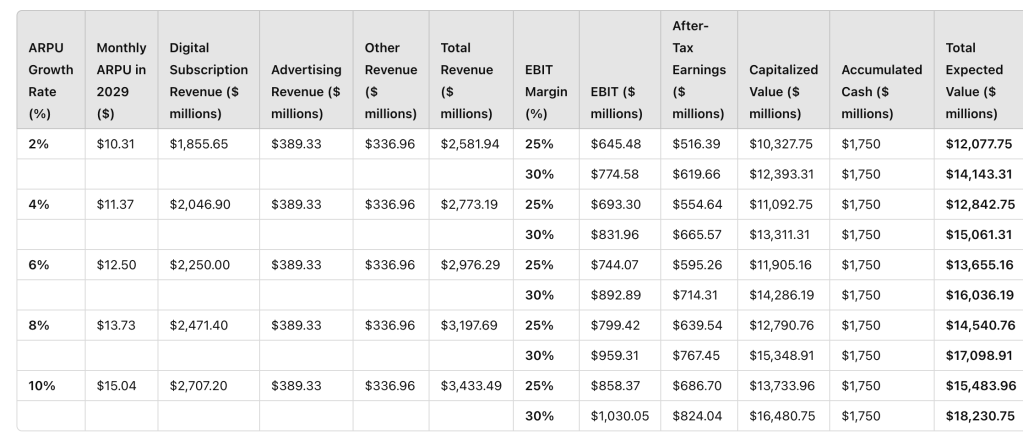

Long-term, we believe that The New York Times can achieve a margin of 25-30% on combined revenues from digital subscriptions, advertising, and other sources. This target margin aligns with the kind of profitability we see in companies like Netflix, which have successfully leveraged their subscription models and diversified content offerings to maximize returns.

Valuation

New York Times

Overall, we estimate the valuation of NYT to be between $12 billion and $18 billion, with a midpoint of approximately $15 billion. Comparing this to the current market cap of $9 billion indicates a potential return of about 50%, which translates to a compound annual growth rate (CAGR) of around 10% over five years. While this outlook is fair, it doesn’t present an exceptionally compelling investment opportunity.

Blackstone

For Blackstone, we believe that valuation hinges on the expectation of an $820 billion fee-earning AUM, which we anticipate will grow at approximately 8% CAGR over the next five years. A similar growth trajectory can be applied to the carry-eligible AUM currently standing at $550 billion. This forecasts fee-earning AUM of approximately $1,200 billion and carry-eligible AUM of approximately $800 billion in five years. By applying a 1% fee on the former and a 1.5% fee on the latter, and assuming a 60% margin for both, along with a 20% tax rate, we estimate total after-tax earnings of approximately $12 billion. Capitalizing this at 20x (25x for fee-earning and 16x for carry-eligible AUM), and factoring in accumulated cash each year of approximately c.$7 billion over five years, we arrive at a target market cap of approximately $280 billion for Blackstone. With the current Blackstone market cap at $210 billion, this translates to a potential gain of approximately 33% or a CAGR of approximately 6% over the next five years. This is a poor return and we’re actively reevaluating our thesis on Blackstone with a good chance that we will sell it and redeploy it elsewhere, unless we see substantial possibility of faster growth in AUM. For instance, if AUM growth is 12%, the potential return will be closer to 10% CAGR.

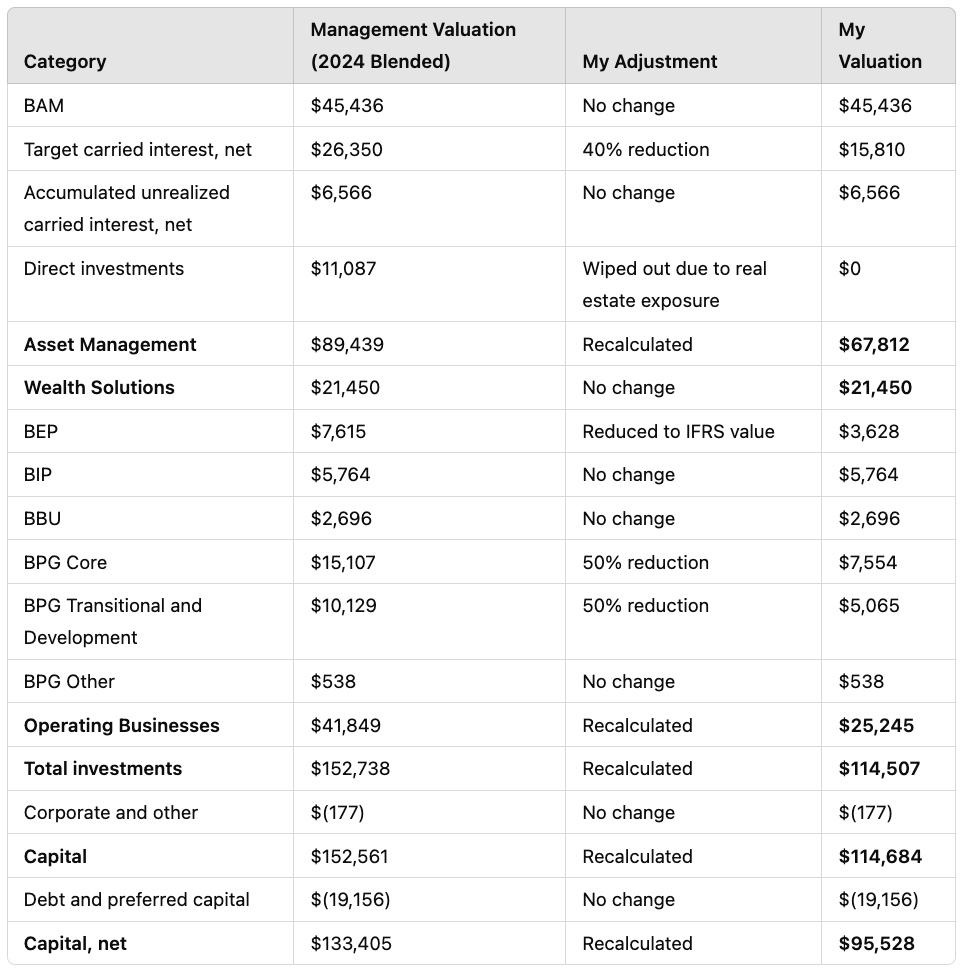

Brookfield

We use Management’s valuation as a starting point and make several adjustments to derive our own estimate of intrinsic value, detailed below. With these adjustments, we believe the current intrinsic valuation of Brookfield is $95 billion, aligning closely with the company’s market cap. Assuming intrinsic earning power grows at 10%, in line with anticipated AUM growth of 10% and with no significant changes to margins, we project a 10% CAGR on the stock at the current share price. This effectively means we are paying nothing for potential margin expansion or for a sustained recovery in real estate. Although we anticipate a recovery in the real estate market, we are not favorable towards how Brookfield has managed its investment operations on the real estate side during this period.