General

Following the run up in interest rate earlier in the year, there has been fluctuations in between, rates went up and down as inflation reports got released and market adjusted its expectations.

Overall, looking at the settled 10 year rate across the world, US yielding 3.8%, UK yielding 3.5%, I’m now adopting a discount rate of about 7-8% to value productive assets – this should give a good margin of safety if interest rate was to rise from this level.

One thing to mention is that I have now kept my long-term terminal growth rate assumption at around 2.5%, owing to higher inflation.

Reading between the lines this works out to be around c.20x as exit P/E multiple.

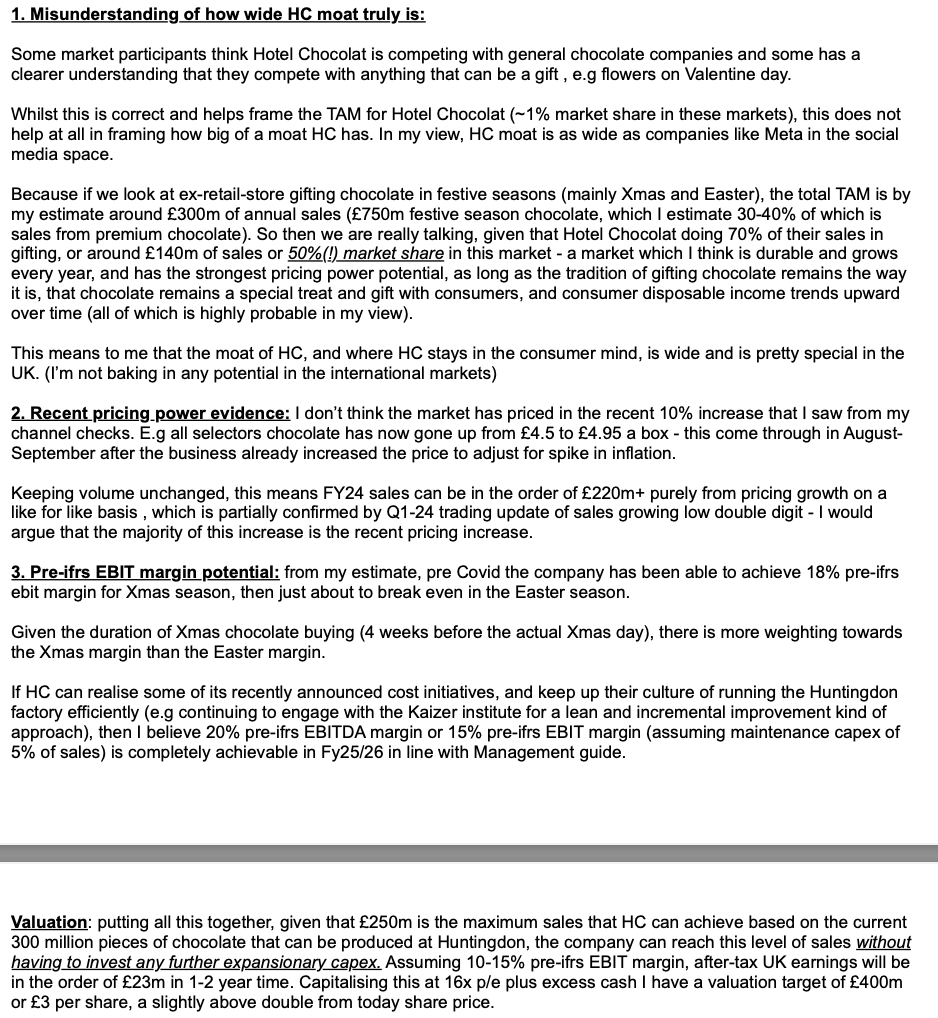

Hotel Chocolat

The most significant update this quarter in my portfolio was Mars Inc’s proposed acquisition of Hotel Chocolat, at a 375 pence per share offer for the whole company. This represents a +200% premium above my cost basis, c.170% premium above the previous trading day.

I certainly did not anticipate a strategic takeover to happen to Hotel Chocolat, but the stock was clearly cheap, trading as low as 7x my assessed normalised earnings at one point during Q3 2024. Mars acquisition represents 20x my assessed normalised earnings.

As with post mortem on fallen stocks, winning idea also gives out its own investing lessons:

- It does open my eyes as to what truly makes up a GREAT investment. One that Buffett would call a “fat pitch”.

- Private market valuation often means smart private buyers always are on the look out for competitors shall they be available at a cheap price. Public market is the only single market where this kind of mispricing can occur frequently.

- The bar for something to become a 20-30% position is now high. An idea needs to have multiple elements to deserve this kind of allocation. As with Hotel Chocolat, and earlier in the year Meta Platforms, competing investment ideas need to have the kind of investment attributes that these 2 ideas exhibited to warrant a big allocation.

For reference I have posted below a write up on Hotel Chocolat I wrote in a stock-pitch email, dated 31 October 2023, just couple weeks before the announced takeover:

Burberry

In the quarter I made a new investment into Burberry, putting about 4% of my portfolio into the stock.

Burberry probably needs little introduction – it is a luxury brand – the only one that represents “Britishness” with large global scale. The company does not operate any other brand.

The investment case for Burberry is underpinned by:

- The currently low valuation of Burberry, which reflects a prolonged slowdown in China (one of Burberry’s main markets, if not the main luxury market of all luxury brands), and that the company will not be able to grow full-price channel at all and destined to forever be a Versace-type , Micheal-Kors-type of brand.

- I have reasons to believe that the transition to full-price channel will eventually be successful, though it will take time, as long as Management is determined to not stray from the full-price focus. Simply assuming conservative assumptions, low single digit growth in full price revenue, 10 years to get to 80% full price revenue from the current 75%, and a modest expansion in margin, then the upside from the current stock price to intrinsic value is a good 50%+.

Other updates

The rest of the portfolio seems to be doing ok:

Meta continues to pull in strong ad revenue, bolstered by past investments into AI. Threads and Reality Labs are two interesting optionalities that are worth monitoring. And yes despite the massive run up in share price of Meta this year, I don’t think market has given any value to these 2 options, meaning the core business is at a fair price and can grow just above overall digital ad growth.

Amazon is also doing well. Retail GMV is up this year, AWS experiences some slowdown but the long-term investment case into the cloud is intact. Cost is coming down as management reigns in in logistical costs (for the first time in the last 5 or even maybe 10 years or so that shipping costs grow significantly slower than revenue). Advertising is the low hanging fruit also. The stock is currently priced at 17x-20x forward my estimated normalised earnings. So it’s far from cheap, and probably a fair(ish) price.

Google is one to monitor. The outcome for a strong growing Google is murky due to the ongoing DOJ suit against its IOS payment to Apple. Whilst this in itself is not the catalyst here, it does throw some spotlight into what actually constitutes Google Search’s moat. Could a competitor with $10bn investment do ok with a so-so search product, layering on top AI features divert some search traffic away from Google?

The lack of a decent alternative to Search in the current Google-Apple world does raise questions on what would happen in the post Google-Apple world. I will keep monitoring this, though my position in Google has drastically declined, from a high of 30% pre Covid to now 7%.

Blackstone continues to grow. The bull case of money moving to privately managed asset manager benefits people like Blackstone is clear. And the stock price reflects it, at a c.20x my normalised earnings the stock is appropriately priced. The upside is all about faster movements of monies flowing into private hands and that is one to watch.

Brookfield is one to monitor. The pain in the real estate arm, with large interest payments resulting in 0 equity return of BPG which accounts for 50% of fee earned from real estate is not great. That said, the market has already discounted this – the stock is valued at around 15x earnings-excluding-all-earnings-from-real-estate (i.e. excluding even fees earned from managing real estate private debts, as an example). That does sound cheap indeed, and one for me to do further research on.

New York Times is doing well, particularly on the emerging success of the strategic decision to bundle subscriptions (news, cookings, etc all together). That said the stock does bake in this, trading at 20x+ earnings. It’s not an expensive valuation, but nor is it cheap. We will continue to watch the pricing power at play here at NYT while growing bundles and a profitability path on the Athletic.